It's become a popular meme that "shareholders only care about the next quarter". Lots of people make arguments like this - for example, Jamie Dimon and Warren Buffet. As the meme goes, shareholders only care about the next quarter of earnings, and CEOs make decisions accordingly - sacrificing long term profitability to meet quarterly expectations.

But is this meme true?

Coronavirus gives us a great empirical test of this theory.

Formalizing the theory

The first step in answering this question is to formalize the theory. The most straightforward way I can think of to do this is through the lens of net present value, albeit with a modified discount rate.

This framework says that the value of any cash generating asset is given by:

In this sum, \(R_t\) is the cash flow in time period \(t\) and \(d_t\) is the discount factor of time \(t\).

Here's a fairly simple example - a US treasury bill guaranteed to pay a $100 coupon for 3 periods and then to pay a final $10,000 in the 4'th. In tabular form:

| date | R |

|---|---|

| 2020-06-30 | 100 |

| 2020-09-30 | 100 |

| 2020-12-31 | 100 |

| 2021-03-31 | 10000 |

To complete the calculation, we need to time discount each cash payment. This is typically done by taking the risk free interest rate - say 5% - and applying that to each time period. For example:

| date | R | d | R*d |

|---|---|---|---|

| 2020-06-30 | 100 | 1.00 | 100.00 |

| 2020-09-30 | 100 | 0.99 | 98.75 |

| 2020-12-31 | 100 | 0.98 | 97.51 |

| 2021-03-31 | 10000 | 0.96 | 9631.85 |

Finally, the value of the bond is the sum of the R*d column, which is $9928.12 in this example.

Short-Termism in this framework

In this framework, short-termism can be straightforwardly represented by the d column - specifically, d will rapidly decrease over time. For instance, a very short term valuation of the same bond (a 25% discount rate) might be described as:

| date | R | d | R*d |

|---|---|---|---|

| 2020-06-30 | 100 | 1.00 | 100.00 |

| 2020-09-30 | 100 | 0.94 | 93.90 |

| 2020-12-31 | 100 | 0.88 | 88.17 |

| 2021-03-31 | 10000 | 0.83 | 8289.90 |

which yields a valuation of $8571.97.

Given that Treasury valuations do not look anything like this, we can certainly see that bond investors are not vulnerable to the short-termism that stock investors purportedly suffer from.

The straw man version of "shareholders only care about the next quarter" would mean that d=0 for all quarters past the next one.

I will examine this model for mathematical understanding, though I don't think it's a particularly fair thing to do.

Modeling an uncertain future

Now let us consider a stock rather than a bond - specifically, a pharma company with a single drug in the final phase of clinical trials which end in 1 year.

The cashflow is quite certain for the next 1 year - R[0:4] == 0, i.e. the company loses money to run the clinical trial and pays nothing to shareholders. After 1 year, there are two possible outcomes:

- The good outcome.

R_good = +1000, the drug works, everyone buys it for 17 years, company is valuable. - The bad outcome.

R_bad = 0, the drug does not work, company is worthless.

| date | R_good | R_bad | d |

|---|---|---|---|

| 2020-06-30 | 0 | 0 | 1.0000 |

| 2020-09-30 | 0 | 0 | 0.9987 |

| 2020-12-31 | 0 | 0 | 0.9975 |

| 2021-03-31 | 0 | 0 | 0.9963 |

| 2021-06-30 | 1000 | 0 | 0.9950 |

| 2021-09-30 | 1000 | 0 | 0.9938 |

| . | . | . | . |

| 2036-06-30 | 1000 | 0 | 0.9231 |

| 2036-09-30 | 1000 | 0 | 0.9220 |

| 2036-12-31 | 1000 | 0 | 0.9208 |

| 2037-03-31 | 1000 | 0 | 0.9197 |

The company has two eventual valuations (at a long-termist 0.5% discount rate), depending on whether we believe the R_good or R_bad column represents the future - $61,238 in the first case and $0 in the second.

If we assume a 60% chance of the drug getting through clinical trials, then the value of the company would be 0.6 * $61238 + 0.4 * 0 = 36742.90.

Note that in the straw man case of literally only the next quarter matters, this company is worth $0 in all possible scenarios - it's first actual profit is 1 year out.

Long term investors appear short term

Lets now consider a long term investor who is evaluating a blue chip, highly stable stock. This stock regularly has earnings of $100. Then one quarter, it misses earnings and only reports $75!

An investor infected by short-termism will significantly cut their evaluation of the company - since d=0 for all future periods, the value drops from $100 to $75, a 25% decrease.

Let us now consider a long term investor.

| date | R | d |

|---|---|---|

| 2020-06-30 | 75 | 1.0000 |

| 2020-09-30 | 100 | 0.9987 |

| 2020-12-31 | 100 | 0.9975 |

| 2021-03-31 | 100 | 0.9963 |

| 2021-06-30 | 100 | 0.9950 |

| . | . | . |

Over 18 years, the value of this revenue stream works out to be $6498. In contrast, had earnings for one quarter not been missed, it would be $6523, a difference of 0.4%. Thus, if there is a drop in share price of significantly more than 0.4%, one might hypothesize that this is due to the market taking a short termist view.

Let us now consider a long term investor who actively tries to think through cause and effect. Earnings decreased, and there must be some reason for it! The question to ask is therefore whether this reduction in a single quarter's earnings will continue into the future. We encounter a situation similar to the pharma stock discussed earlier:

| date | R_good | R_bad | d |

|---|---|---|---|

| 2020-06-30 | 75 | 75 | 1.0000 |

| 2020-09-30 | 100 | 75 | 0.9987 |

| . | . | . | . |

| 2036-09-30 | 100 | 75 | 0.9220 |

| 2036-12-31 | 100 | 75 | 0.9208 |

| 2037-03-31 | 100 | 75 | 0.9197 |

In the R_bad scenario, the company will only be worth $4892 (a 25% decrease from it's previous value).

If the long term investor believes that there is a 40% chance of this occurring, then the value of the stock decreases to $5855.75, a 10% drop!

Even though the long term investor doesn't care much about a single quarter's earnings, he cares a lot about whether this predicts many more quarters of reduced earnings. This means that even long term investors behave in the manner that others describe as "short-termist".

As a result, both the short-termism theory and the long-termism theory make very similar predictions. The fact that stock prices move significantly in response to missed earnings estimates is insufficient to distinguish between these two theories.

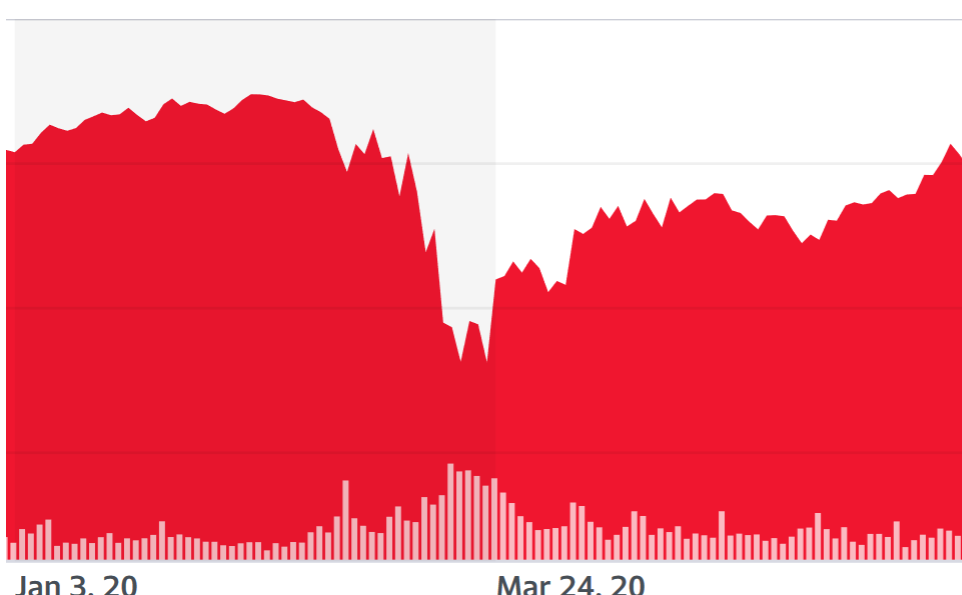

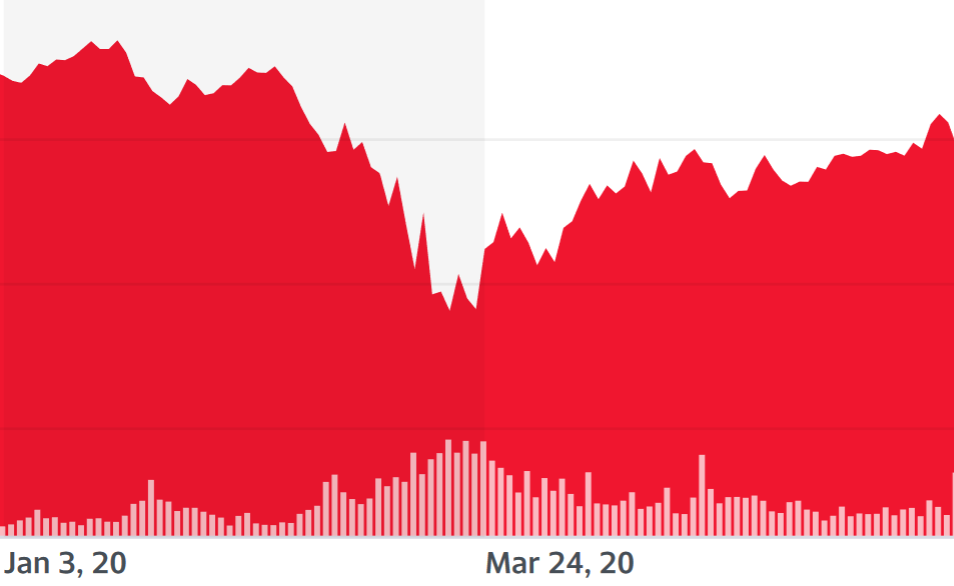

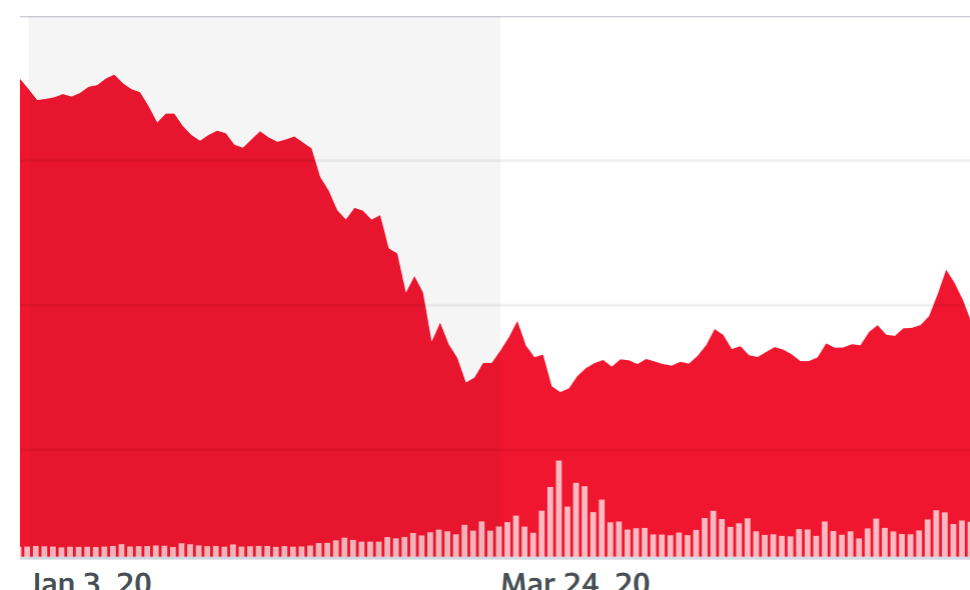

The Short-Termism theory has died of COVID

Coronavirus is a great natural experiment for a lot of things.

One of the most important things we can take away from it is the conclusion that equity markets are fundamentally focused on the long term value of the companies being traded. There are fast responses to problems with next quarter earnings, but these are primarily driven by the fact that problems in the short run tend to be indicative of more fundamental issues.

Now that we have a systematic example where we know that short run problems are strictly short run, we can safely disambiguate between short termism and long termism. The result is very clear; the market is predominantly focused on the long term.

Disclosure: Long $SBUX, $CCL.